Bimco reported that concerns remain regarding fleet expansion once ships can return to their normal routes. BIMCO estimates that fleet growth will increase supply by 46% in 2026 compared to 2019 before the contracting boom began. Cargo volumes are forecasted to increase ship demand by 22% between 2019 and 2026.

Although BIMCO expects average sailing speeds to continue declining, reducing supply, growth forecasts still indicate that the supply/demand balance will be weaker than in 2019 once ships can return to normal Suez Canal routes. Notably, 2019 was a year when freight rates were significantly lower than in recent years.

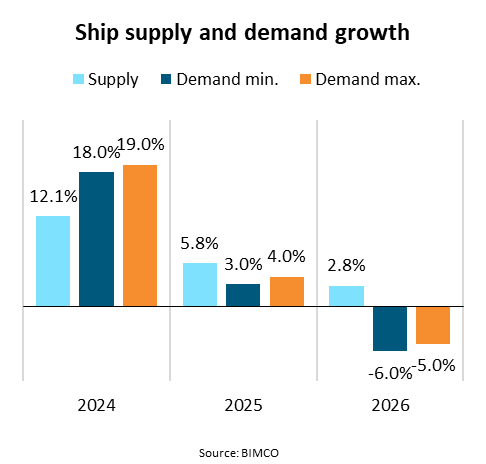

In fact, BIMCO has revised its assumptions regarding when ships can return to normal Suez Canal routes. The organization now assumes that reroutings will impact all of 2025, with ships returning to normal routes throughout 2026. Consequently, BIMCO’s forecast indicates a slight weakening of the supply/demand balance in 2025, followed by a significant weakening in 2026 as ship demand is expected to fall.

Conversely, if ships can return to the Suez Canal throughout 2025, BIMCO expects a significant weakening of market conditions, followed by a slight improvement in 2026. If ships cannot return to normal routes in 2026, the slight weakening of the supply/demand balance in 2025 is expected to be followed by a slight tightening in 2026.

Following very weak growth in 2023, BIMCO estimates that cargo volumes will grow by 5.5-6.5% in 2024, with forecasted growth of 3-4% in 2025 and 3.5-4.5% in 2026. BIMCO also forecasts that import volumes into South & West Asia and South & Central America will grow the fastest.

The International Monetary Fund (IMF) forecasts faster economic growth for many oil-exporting countries in West Asia, which should help lift volumes into the area. In South America, Argentina is expected to emerge from recession, driving higher volumes into the region.