The Philippines should take advantage of the Brunei Darussalam-Indonesia-Malaysia-Philippines East ASEAN Growth Area (BIMP-EAGA) to forge a legal partnership to help curb illicit cigarette trade proliferating in Southern Mindanao largely driven by weak enforcement and governance gaps, rather than high taxes.

This was raised by Zamboanga Vice Mayor Maria Isabelle “Beng” Climaco during the launch Tuesday, Nov. 11, of a new study “Illicit Tobacco Trade in the Philippines: Findings from Sari-Sari Store Surveys and Empty Pack Audits,” by Action for Economic Reforms (AER) and Economics for Health of the Johns Hopkins Bloomberg School of Public Health.

Climaco said that aside from strong enforcement along the wide coastal and porous areas, the Philippines must also look at opportunities with its neighbors through the BIMP-EAGA.

“We must also look at partnership among BIMP countries so we can foster legal economy that can also benefit and that is how we can also support our neighbors,” Climaco said.

Daffodil Santillan, AER lead researcher for the study, said the largest smuggled cigarettes in the country entered through the Southern Mindanao, particularly General Santos and Zamboanga and most of the supply come from Indonesia and Malaysia, which have also a thriving illicit trading activities in the area.

She noted that because of the proximity of Southern Mindanao to Malaysia and Indonesia, Zamboanga has a thriving barter trade economy with goods coming from the BIMP countries.

The study also showed that the prevalence of illicit tobacco smuggling in Southern Mindanao is largely a combination of historical, cultural and geographical factors that have been exploited because of the weak enforcement of laws in the areas. In fact, locals call the illicit trading “legal smuggling” or “backdoor trading.”

While Indonesia and Malaysia cigarette labels dominate the illicit trade for Southern Mindanao, various brands from Thailand, South Korea, United Arab Emirates, London, and Switzerland.

Study

The new study, which focuses on sales by sari-sari stores, showed that illicit tobacco trade in the Philippines is being fueled by weak enforcement and governance gaps, not by high tobacco taxes that the tobacco industry has long claimed.

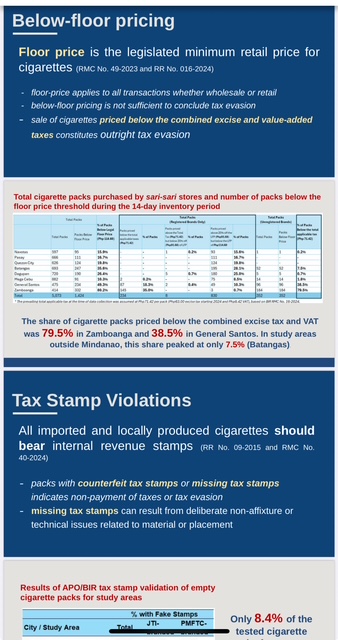

The research was based on surveys of more than 1,000 sari-sari stores and an audit of over 7,500 cigarette packs in eight key cities—Dagupan, Navotas, Quezon City, Pasay, Batangas, Mega Cebu, Zamboanga, and General Santos. The results found that due to weak enforcement and geographical location, Southern Mindanao, particularly Zamboanga and General Santos, has the highest prevalence of illicit tobacco trade.

In Zamboanga City alone, nearly 80 percent of packs were priced below applicable taxes, while up to 96 percent of inspected packs had fake or missing tax stamps.

Meanwhile, the results show that the prevalence of illicit cigarette sales in Luzon, Visayas, and Metro Manila is low.

These findings come after Congress debated proposals to reduce tobacco taxes in January of this year, a move public health experts warn would only worsen smoking rates and would be ineffective in curbing smuggling.

“The results disprove the tobacco industry’s narrative that high taxes cause smuggling,” said Santillan. “The evidence shows the real issue is weak law enforcement and regulatory oversight, especially at ports and borders. Lowering tobacco taxes will only make cigarettes cheaper and Filipinos sicker.”

The study emphasizes that tobacco excise tax rates—applied uniformly nationwide—cannot explain regional disparities in illicit trade. Instead, local political will, maritime governance, and enforcement intensity determine where illicit products thrive.

For her part, Climaco underscored the importance of local government action. “During my term as Zamboanga City Mayor, I led an uncompromising campaign against smuggling in Zamboanga City, initiating investigations into Customs officials and over the disappearance of smuggled sugar and rice from warehouses, demanding full accountability,” Climaco said.

“As Regional Peace and Order Council Chair for two terms, I also coordinated with law enforcement agencies down to the Barangay and personally oversaw midnight operations and confiscations, underscoring my firm resolve to protect the city from illicit trade and corruption.”

Bills seek to lower tobacco excise tax

AER urged the government to reject proposals to lower tobacco excise taxes, such as House Bill 11360, which was hastily passed in the House of Representatives earlier this year with minimal deliberation and limited stakeholder consultation. AER also warned against House Bills 5207, 5212, and 5364, lowering taxes on vape and heated tobacco products. The group warned that tax rollbacks will reverse a decade of health and fiscal progress.

Since 2012, tobacco tax reforms have reduced adult smoking prevalence from 29.7 percent in 2009 to 19.5 percent in 2021, a significant public health achievement, while significantly increasing revenue for health programs, demonstrating the effectiveness of the current tax system.

Recommendations

To address illicit trade and protect the gains of tobacco tax reform, AER recommends some the actions.

Foremost is the upgrading the current tax stamp system into a comprehensive, up-to-date track-and-trace system with physical and digital markers, independent of the tobacco industry.

Other recommendations include:

- Licensing all tobacco retailers, including sari-sari stores, to ensure compliance;

- Empowering the Bureau of Internal Revenue (BIR) to suspend or close violators; and

- Tightening coordination among Customs, BIR, and local governments in enforcement hotspots.

- Stem illicit trade at the source by strengthening cooperation, especially with neighboring countries through multilateral and bilateral means.

“Tobacco tax reforms save lives and fund the healthcare of the most vulnerable Filipinos,” said Senator Risa Hontiveros, Chair of the Senate Committee on Health and Demography, at the launch. “It’s time to protect public health and public revenues through stronger enforcement. Lowering taxes at this point, when our economy is struggling and [the] government needs revenues, may not be a good idea.”